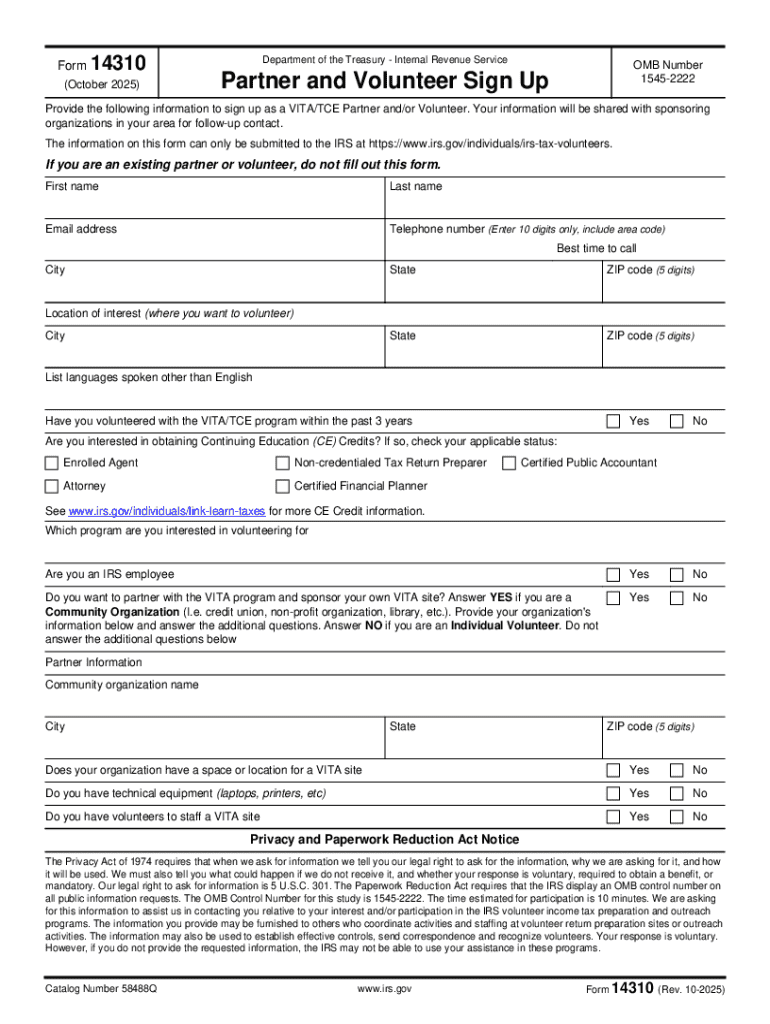

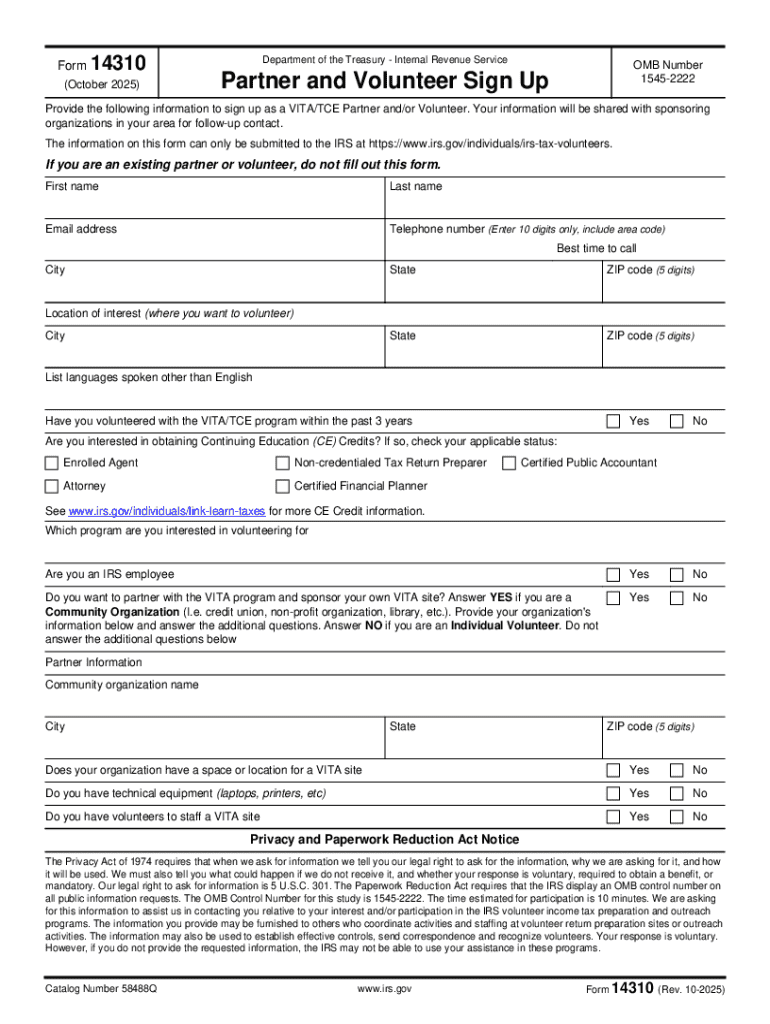

IRS 14310 2025-2026 free printable template

Get, Create, Make and Sign vita tce volunteer form

Editing tax preparation offices near me online

Uncompromising security for your PDF editing and eSignature needs

IRS 14310 Form Versions

How to fill out form 14310

How to fill out form 14310 rev 10-2025

Who needs form 14310 rev 10-2025?

Comprehensive Guide to Form 14310 Rev 10-2025

Understanding Form 14310 Rev 10-2025: An overview

The Form 14310 Rev 10-2025 is an essential document for coordinating various administrative processes, especially in workplace environments. This form serves multiple purposes, such as authorizing access or providing information necessary for compliance and reporting. Its significance extends to industries involving employees, volunteers, and coordinators, where accurate documentation is crucial for operational efficiency.

With each new revision, especially the 2025 update, there are notable enhancements aimed at simplifying the user experience. This version boasts streamlined sections, clearer instructions, and the inclusion of digital features catering to a modern, tech-savvy audience. Individuals and teams who frequently engage with Form 14310 should familiarize themselves with these updates to ensure compliance and accuracy.

This form is generally used by employees, volunteers, and their coordinators, ensuring that all parties are informed and compliant with specific protocols. Whether you're a filer handling these documents or a team member submitting requests, understanding the intricacies of the Form 14310 Rev 10-2025 is vital for seamless operations.

Getting started with Form 14310

Accessing Form 14310 Rev 10-2025 is straightforward, especially with the pdfFiller platform. Users can navigate through the site to locate the form in just a few clicks. pdfFiller provides a cloud-based solution, enabling you to access and download the form from anywhere, facilitating easy collaboration among teams.

The platform also offers a range of PDF editing tools, allowing you to modify the document easily. These tools include text editing, the ability to add images or signatures, and options for commentaries or notes. This convenience significantly enhances the management of documents, making it easier for teams to coordinate efforts without the hassle of physical paperwork.

Step-by-step guide to completing Form 14310

Completing Form 14310 Rev 10-2025 involves several key sections. Each section requires precise information to ensure proper processing. Start by filling out personal details of filers, which is typically the first section. Subsequent sections may include purpose statements or detailed requests relevant to the form's intent.

Field by field, it’s crucial to understand certain terminologies. For instance, the term 'filers' refers to the individuals completing the form, while 'form purpose' specifies the objectives behind the document submission. When entering data, clarity is paramount. Ensure that information is accurate, as discrepancies can lead to delays or complications.

Common challenges include uncertainty in specific fields or missing documentation. It’s advisable to double-check entries and refer to the FAQ section for assistance. Consistent practice in filling out these forms will lead to proficiency over time.

Editing and modifying Form 14310 on pdfFiller

Once Form 14310 Rev 10-2025 is completed, users may need to edit or modify information. pdfFiller's suite of editing tools is designed for ease of use, allowing seamless text updates without requiring advanced technical skills. This feature is essential for teams that periodically update information or need to respond to changing circumstances.

Additionally, users can add notes or comments for greater clarity. This function facilitates collaboration, making it possible for team members to provide feedback or insights directly within the document. Such integrations not only improve accuracy but also streamline team communication.

eSigning Form 14310: Ensuring compliance and security

After editing, the next critical step in handling Form 14310 Rev 10-2025 is adding an electronic signature. This can be conveniently accomplished within pdfFiller. Electronic signatures are not only quick but also legally recognized, ensuring that your submission is compliant and secure.

To add your electronic signature, users can either draw it, upload an image of their signature, or type it with a designated font. It's essential to follow best practices when signing, such as verifying the contents of the form thoroughly before submission. This process safeguards against potential discrepancies that might arise post-submission.

Managing and submitting Form 14310: Everything you need to know

Once Form 14310 Rev 10-2025 is completed and signed, managing your document efficiently becomes vital. pdfFiller provides multiple options for saving your completed form, from easy downloads to cloud storage. Sharing features are also robust, allowing proper distribution among team members or supervisors.

Submission guidelines should be carefully followed, including monitoring deadlines to avoid penalties or missed opportunities. After submission, it's wise to verify receipt of the form and track its status. This ensures that your request or information submission is acknowledged and being processed as expected.

Troubleshooting tips for common form errors

While filling out Form 14310 Rev 10-2025, several common errors can arise. This could range from typographical errors in personal information to incomplete sections due to oversight. Identifying these mistakes early is critical, as they can lead to rejection or unnecessary delays in processing.

Solutions to these errors often lie in thorough reviews before submitting. If discrepancies arise, users should correct them directly on pdfFiller and save the updates promptly. In cases where professional assistance is needed, pdfFiller’s support team is readily available, ensuring users have access to help when encountered with complexities.

Leveraging additional features of pdfFiller for document management

Beyond just editing and signing, pdfFiller offers additional features that can significantly enhance your document management processes. Collaboration tools within pdfFiller empower teams to work together on documents, enabling real-time feedback and edits. This functionality ensures all team members stay informed and aligned.

Tracking edits and comments also helps improve the workflow. Users can easily see who made changes and when, promoting accountability. Integrating other documents and templates from pdfFiller's library into your workflow not only saves time but ensures consistency across submissions, ultimately streamlining your operations.

Real-life use cases for Form 14310

Form 14310 Rev 10-2025 sees extensive use across various industries, with each sector finding unique applications for the document. For instance, in nonprofit sectors, volunteers often use the form to submit reports or feedback regarding their activities. This facilitates better communication between coordinators and field staff.

Success stories from teams utilizing Form 14310 showcase time savings and improved accuracy in documentation. Organizations report that shifting to pdfFiller reduced processing times significantly, as submissions became systematic and structured. User feedback highlights the ease of use and collaborative features as key benefits of embracing this platform for form management.

Best practices for future form management with pdfFiller

To ensure effective management of Form 14310 and similar documents, adopting best practices is imperative. Staying updated on form revisions, like the recent 2025 update, can provide significant advantages. Users should regularly check pdfFiller for updates to make sure they use the most current versions.

Setting reminders for deadlines related to submissions can prevent late filings. pdfFiller also offers tools that allow users to schedule alerts, making tracking important dates hassle-free. Furthermore, utilizing training materials provided by pdfFiller can enhance your team’s proficiency with document management processes, ensuring all members are on the same page.

People Also Ask about irs form 14310

How do I download old tax forms?

Are tax returns required for irrevocable trust?

How do I prepare an irrevocable trust tax return?

What is the tax return for an irrevocable trust?

Can I file 2014 tax return in 2020?

What is a Vita form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get irs payment plan online?

How do I complete cbp form 301 on an iOS device?

How do I edit IRS 14310 on an Android device?

What is form 14310 rev 10-2025?

Who is required to file form 14310 rev 10-2025?

How to fill out form 14310 rev 10-2025?

What is the purpose of form 14310 rev 10-2025?

What information must be reported on form 14310 rev 10-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.